Tag: Financial Stewardship

-

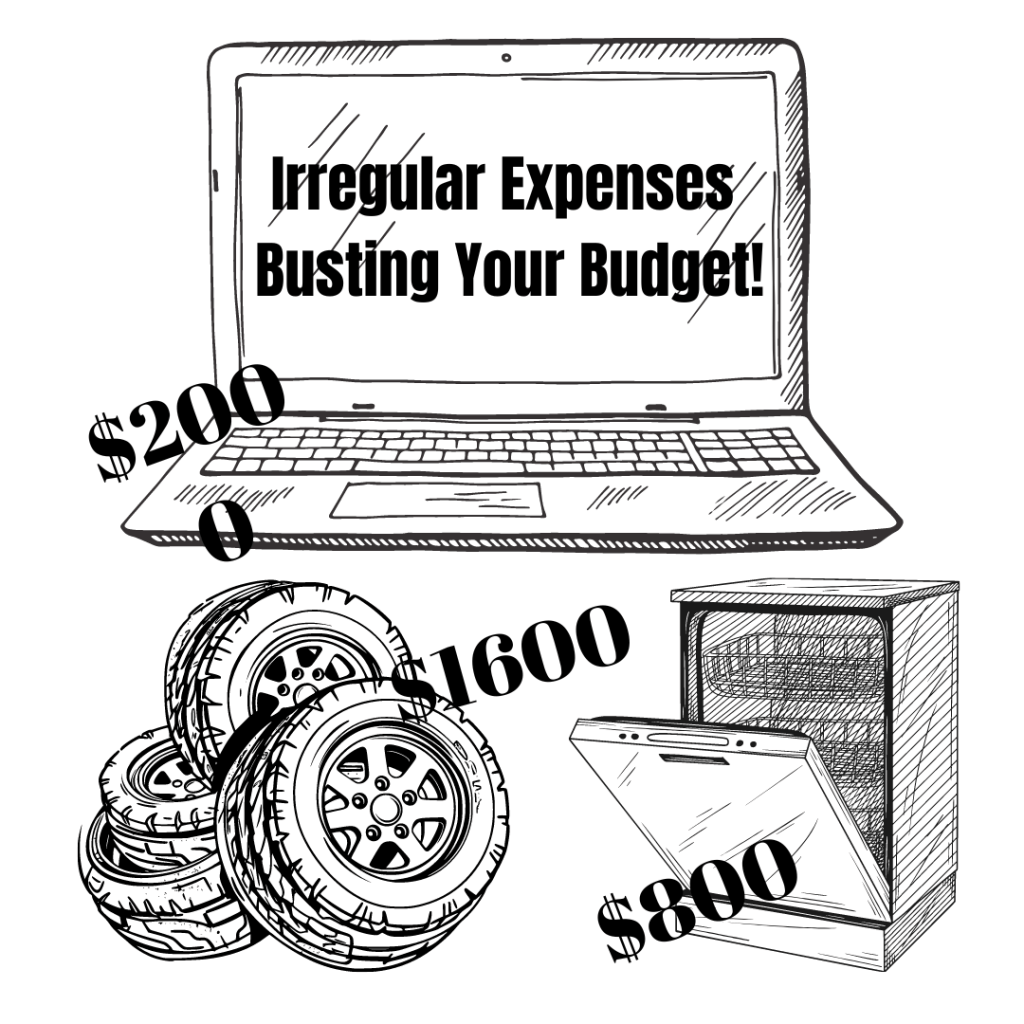

Are Irregular Expenses Busting Your Budget?

Dishwasher goes kaput, tires are going bald, or accidentally spill coffee on your laptop? These unfortunate expenses are not regular, but they do happen, and sometimes they are “expensive,” which can break your budget. Are irregular expenses busting your budget? It is easy to carefully budget for your regular expenses like groceries, gas, and electricity…

-

1 Month In

As we find ourselves one month into 2024, it’s a great time to re-evaluate our goals, including our financial aspirations. We all start the new year with great enthusiasm and excitement, but as February rolls in, it’s important to remember that this month can be a critical indicator of our ability to continue pursuing our…

-

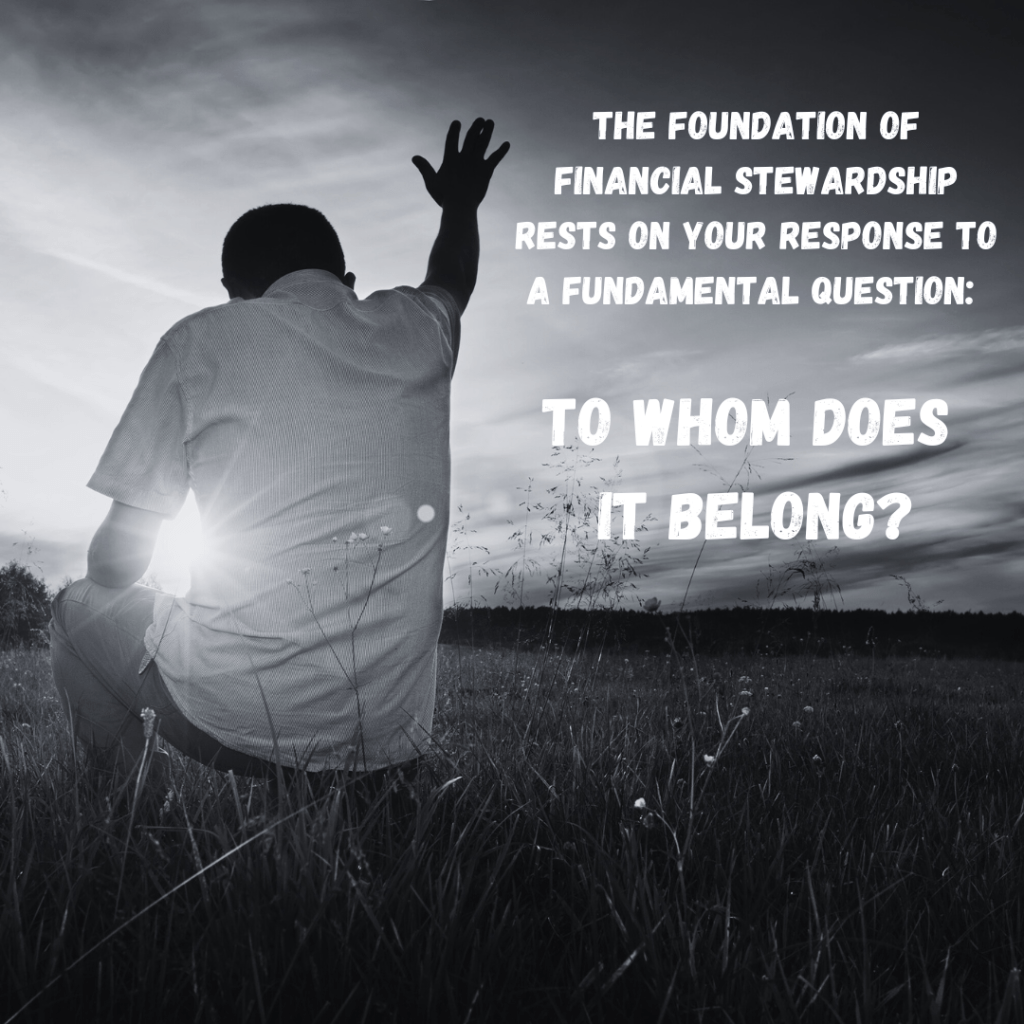

To Whom Does It Belong?

1 Chronicles 29:12-14: Wealth and honor come from You; You are the ruler of all things. In Your hands are strength and power to exalt and give strength to all. Now, our God, we give You thanks, and praise Your glorious name. But who am I, and who are my people, that we should be…

-

Inputs vs Outputs

In the realm of financial investments, it’s imperative to recognize that while we cannot always fully control the output of our investments, we have a significant influence over the inputs. These inputs can range from saving for a home, investing in a second property, allocating funds towards an Index Fund, or even exploring opportunities within…

-

Seed Time Isn’t Harvest Time

Just as in nature, there is a designated time for sowing and another for reaping, the same principle applies to our financial endeavors. Seed Time represents the period of investment, hard work, and laying the groundwork for future rewards. It’s a time of patience and faith as you wait for your efforts to bear fruit.…

-

The 1 Talent

Do you recall the servant in the book of Matthew who received only one talent while others received two and five? This story often resonates deeply with many individuals because it reflects the feeling of being born with less. However, the message of the parable is clear: we are responsible, regardless of how much we’ve…

-

Can You Handle The 40/40/20 Rule?

Can you truly live off the 40/40/20 rule? This extreme method of budgeting seems like a fast track way to build wealth, but is it sustainable? Let’s explore this rule and see if this would work on a $125,000 income. Basics: Based on Gross Income Using this formula, let’s see an example based on a…

-

Spend Less, Invest More

As Christian fathers, we are tasked with providing and caring for our families. One simple way to enhance our financial security and provide for our families’ future is by adopting the mindset of spending less and investing more. The year 2024 is full of potential for our financial growth and stability. One practical approach to…

-

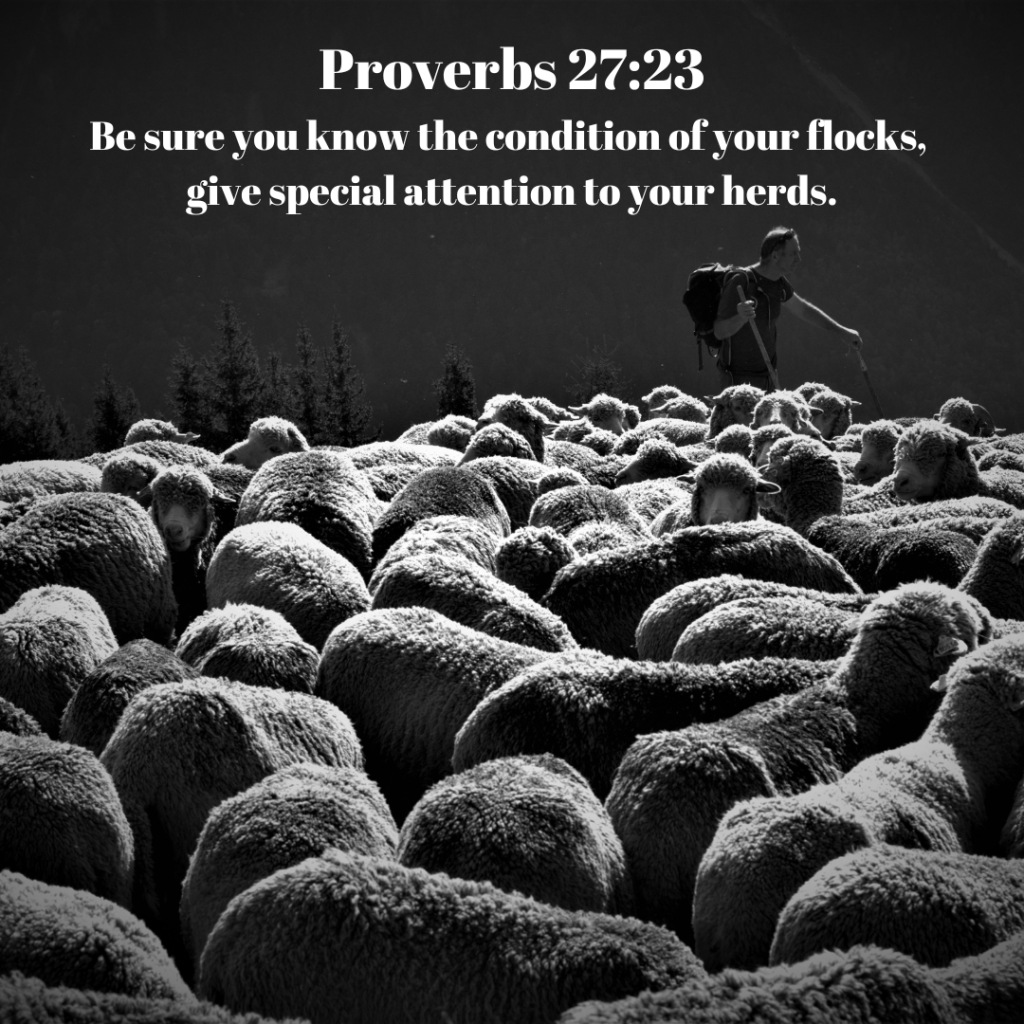

Proverbs 27:23

Do you know where you are financially? Do you know where you want to be in 5 years? As a Christian father, it’s crucial to heed the wisdom found in Proverbs 27, which advises knowing the state of your flocks. In modern terms, this can translate to understanding your current financial position. It’s important to…

-

$1 Trillion Debt Challenge

In 2023, Americans encountered a staggering milestone, collectively amassing over $1 trillion in credit card debt. The average household found itself burdened with over $6,000, compounded by a relentless average credit card interest rate of 22%. A nation drowning in financial strain, seeking a way out. As we embark on the journey of 2024, it’s…