Tag: Budgets

-

44% of Americans

Nearly half of Americans, about 44%, struggle to pay for a $1,000 unexpected expense, showing that many people face tough financial situations. This highlights the importance of better money knowledge and support to help people manage their money better. Here are five blog posts to get you on the right path. The Importance of Contentment…

-

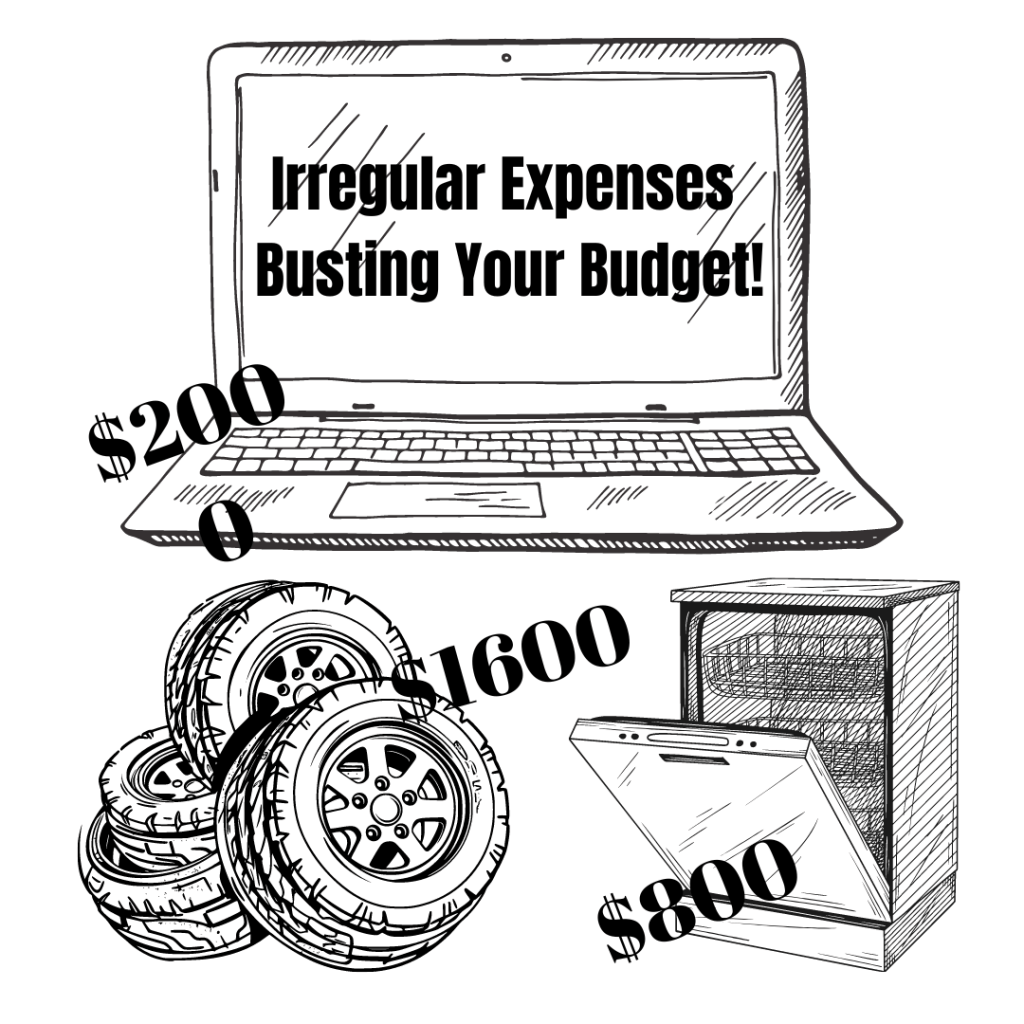

Are Irregular Expenses Busting Your Budget?

Dishwasher goes kaput, tires are going bald, or accidentally spill coffee on your laptop? These unfortunate expenses are not regular, but they do happen, and sometimes they are “expensive,” which can break your budget. Are irregular expenses busting your budget? It is easy to carefully budget for your regular expenses like groceries, gas, and electricity…

-

Recalibrate Your Budget

That moment when your bills surpass your income—it happens to many of us, and it has recently been affecting my household. With the continued rising costs of living, it is important to recalibrate your budget and lifestyle. There will be seasons when you have the luxury to spend on “wants,” and there will be seasons…

-

Breaking Free From the Paycheck to Paycheck Cycle

Are you tired of living paycheck to paycheck? Does it feel like an endless struggle with no light at the end of the tunnel? Absorb, reflect, and take these concrete steps to transform your lifestyle, beginning to save and invest for your future. None of the steps below are easy, and they require hard work,…

-

5 Ways to Save Money Now!

According to the Bureau of Labor Statistics, the average American spends $5,577 a month on expenses. That is a staggering $69,324 a year, and that is without taxes calculated into the equation. Let’s collectively lower this average as Christian fathers and figure out small changes that can bring that amount down. No matter your financial…