Category: Budgeting

-

Lesson of Saving for Feast and Famine

Lesson of Saving for Feast and Famine

-

44% of Americans

Nearly half of Americans, about 44%, struggle to pay for a $1,000 unexpected expense, showing that many people face tough financial situations. This highlights the importance of better money knowledge and support to help people manage their money better. Here are five blog posts to get you on the right path. The Importance of Contentment…

-

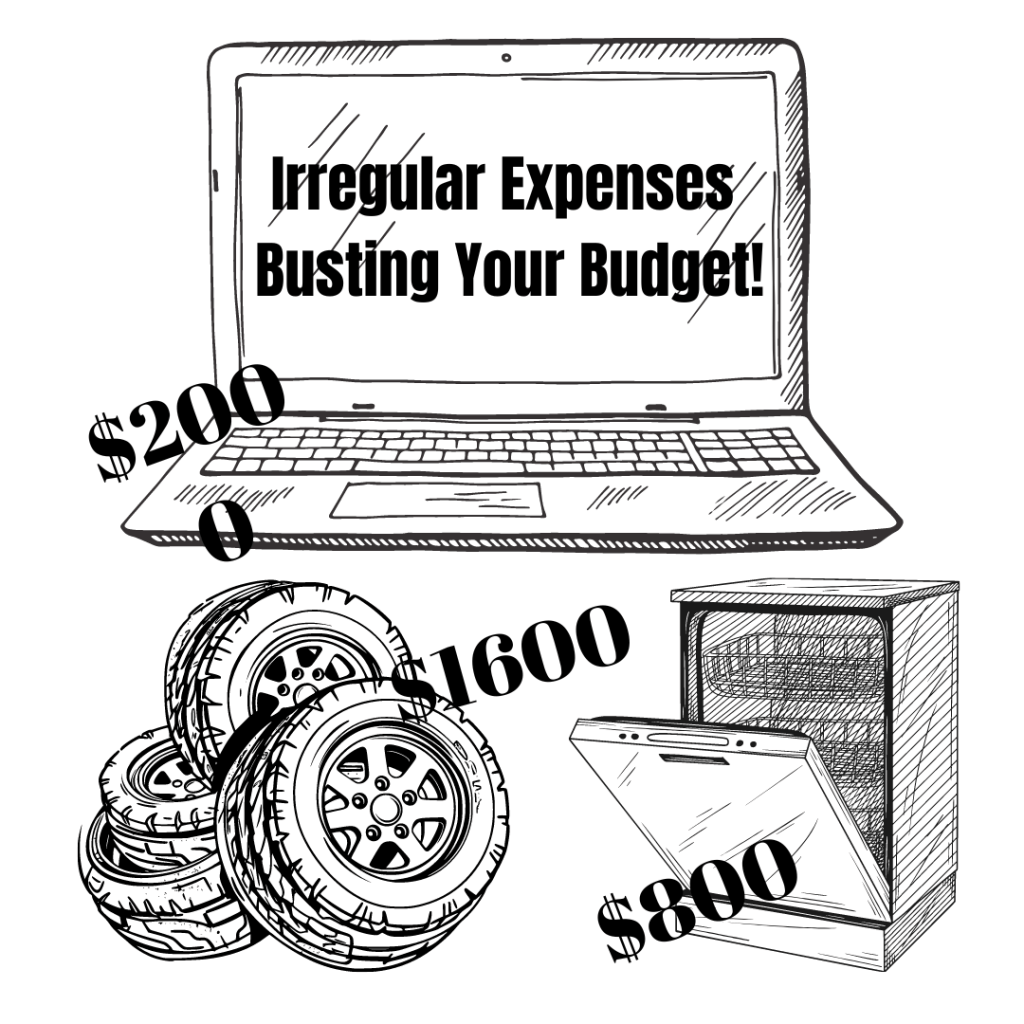

Are Irregular Expenses Busting Your Budget?

Dishwasher goes kaput, tires are going bald, or accidentally spill coffee on your laptop? These unfortunate expenses are not regular, but they do happen, and sometimes they are “expensive,” which can break your budget. Are irregular expenses busting your budget? It is easy to carefully budget for your regular expenses like groceries, gas, and electricity…

-

Can You Handle The 40/40/20 Rule?

Can you truly live off the 40/40/20 rule? This extreme method of budgeting seems like a fast track way to build wealth, but is it sustainable? Let’s explore this rule and see if this would work on a $125,000 income. Basics: Based on Gross Income Using this formula, let’s see an example based on a…

-

Spend Less, Invest More

As Christian fathers, we are tasked with providing and caring for our families. One simple way to enhance our financial security and provide for our families’ future is by adopting the mindset of spending less and investing more. The year 2024 is full of potential for our financial growth and stability. One practical approach to…

-

$1 Trillion Debt Challenge

In 2023, Americans encountered a staggering milestone, collectively amassing over $1 trillion in credit card debt. The average household found itself burdened with over $6,000, compounded by a relentless average credit card interest rate of 22%. A nation drowning in financial strain, seeking a way out. As we embark on the journey of 2024, it’s…

-

Lifestyle Creep

1 Peter 3:3-4 “Your beauty should not come from outward adornment, such as elaborate hairstyles and the wearing of gold jewelry or fine clothes. Rather, it should be that of your inner self, the unfading beauty of a gentle and quiet spirit, which is of great worth in God’s sight.” I just recently learned this…

-

Recalibrate Your Budget

That moment when your bills surpass your income—it happens to many of us, and it has recently been affecting my household. With the continued rising costs of living, it is important to recalibrate your budget and lifestyle. There will be seasons when you have the luxury to spend on “wants,” and there will be seasons…

-

Cost of Living Reality

Choosing where to lay down your roots is a journey that transcends mere geography; it’s a financial saga that can shape the rest of your life. Where you may have grown up may not be the place you raise your own family. Times change, and the economics of a given region may not be sustainable…

-

Maximize Your Tax Benefits with FSA

If the acronym FSA isn’t a familiar term in your workplace discussions, it’s time to pay a visit to your HR department and explore its potential as a tax-saving tool. Let’s be honest; finding ways to trim down our tax payments is always a welcomed pursuit. Enter the Flexible Spending Account (FSA), a pre-tax financial…